In 1947, Malayan Airways Limited started flight services

between Singapore, Kuala Lumpur, Ipoh and Penang (Securities Investors

Association (Singapore), 2006). In 1955, international routes were introduced (Securities

Investors Association (Singapore), 2006). The airline was renamed Malaysian

Airways Limited with the formation of the Federation of Malaysia on 1963 and

then to Malaysia-Singapore Airlines Limited (MSA) in 1966 when Malaysia and Singapore

acquired joint control (Securities Investors Association (Singapore), 2006). In 1971, MSA was restructured to Malaysian

Airlines System Berhad and Singapore Airlines Limited (Securities Investors

Association (Singapore), 2006). On 28 January 1972, SIA was incorporated as a

wholly-owned subsidiary of the Singapore government through Temasek Holdings

Private Limited, making SIA a public company with limited liabilities (Securities

Investors Association (Singapore), 2006). On August 2013, SIA has 102 aircrafts, 14156

employees and served 62 airports or 34 countries (Star Alliance, 2013). SIA is

also a member of Star Alliance. SIA has a frequent Flyer Programme, KrisFlyer

which gives additional benefits to its loyal customers (Star Alliance, 2013).

The load factor, yield and cost determined the SIA profit (Pangarkar

et al, 2010, p.31). Load factor is defined as the percentage of seats occupied

in a flight while yield is the revenue for each kilometre travelled by each

customer (Pangarkar et al, 2010, p.31). Unit cost is calculated on the basis of

available seat kilometres (Pangarkar et al, 2010, p.31).

Source: SIA Annual Report 2012/2013

For SIA to maximise revenue, SIA will have to try to

identify the willingness and ability of the passengers to pay different fares (Pangarkar

et al, 2010, p.31). Generally, SIA passengers can be divided into business

travellers and leisure travellers (Pangarkar et al, 2010, p.31). Business travellers

have a slightly inelastic price elasticity of demand and a more elastic time

elasticity of demand (Anon, 2010). Business travellers are more willing to pay

a premium price for extra amenities such as quality of food, service quality,

comfortable seating (Anon, 2010). Travel

flexibility, last minute seat availability and low cancelation/delay of flights

are also important for a Business traveller (Anon, 2010). Leisure travellers

have a more elastic price elasticity of demand and an inelastic time elasticity

of demand (Anon, 2010). Leisure travellers are willing to change day and time

to get the lowest airfare (Anon, 2010). They will also switch to a different

airline with a lower airfare or not travel at all if the fare is too high (Anon,

2010). Flying is a necessity for business travellers who deal with

international market but flying is a normal/luxury good to leisure travellers.

The

market structure for SIA is an oligopoly. Oligopoly is a market structure

whereby a small number of firms share a larger proportion of the industry and

the barrier to entry is high (Sloman et al, 2012, p.197). SIA is an oligopoly

as SIA holds a market share of 33% of the airline market in Singapore.

Figure: Singapore capacity share (% of seats) by brand:

05-Nov-2012 to 11-Nov-2012

As SIA is an oligopoly, SIA is a price maker instead of a

price taker (Sloman et al, 2012, p.197). SIA practises the third degree of

price discrimination. The price difference between the economy class and the

business and first class is very big (Pangarkar et al, 2010, p.31). Lower

income consumers treat flying as a luxury while flying is a normal good for

higher income consumers. SIA targets the lower income consumers (economy class)

with a lower price and higher amount of seating to sell as many as seats as

possible while selling less seats at a higher price to the higher income

consumers (business and first class) with the attraction of comfort, quality

(Wells,2012). During the holiday season, the demand of air travel by the

leisure travellers will increase. As the demand for seats are more than the

supply of seats the fare will increase. SIA sells seats in blocks (Anon, 2013).

Travellers who book early get the seat at base price, for every additional

block sold afterwards, the price will increase as there is great demand for the

limited available seats(Anon, 2013).

Profit Maximising output under third degree price

discrimination

Source: Learn Economics Online (2013)

Market X is business travellers and market Y is leisure

travellers. MR* is the total marginal revenue (horizontal addition of the 2 MR

curves) of SIA (Sloman, 2012, p.217). Total profit is maximised at MR=MC at

output Q*(Q* = Q1+Q2) (Sloman, 2012, p.217). Q* is then

divided between the markets by selling that amount in each market where MR=MC at

the price determined by the relative demand curve of each market. Price

discrimination increases the profit of SIA (Sloman, 2012, p.217).

Some of SIA major rivals are Air China, Cathay Pacific

Airways and Qantas Airways (Fickling, 2012). SIA passenger count has fallen due

to the increase elasticity of price elasticity of demand by business travellers

as well as rival airlines providing better amnesties (Fickling, 2012). SIA’s profit

margins were also affected by the high fuel prices and weak economic environment(Fickling,

2012).

The effect of the rivals’ reaction on the change of price

and output of SIA is the elasticity of the downward slopping demand curve

(Tutor2u). This can be illustrated by the kinked demand curve theory. There are

two assumptions made by the theory. The first assumption is if SIA cuts their

price, its rivals will be forced to follow its example and cut their prices to

prevent the decrease in market share (Spaulding, 2013). The demand curve will

be more inelastic for this part (Spaulding, 2013). The second assumption is if SIA

increase their prices, its rivals will maintain their price to gain more market

share (Spaulding, 2013). This will make the demand curve more elastic (Spaulding,

2013). This difference in elasticity will create a kink in the demand curve of

SIA. As the marginal revenue curve depends on prices, the marginal revenue

curve is also kink and below the demand curve (Spaulding, 2013). Profits are

maximised at MR=MC. So if the MC curve lies anywhere between MC1 and

MC2, the profit maximising price and output will P1 and Q1

(Sloman, 2012, p.207). The price will remain constant even with changes

to the costs (Sloman, 2012, p.207).

Oligopoly is not productive and allocative efficiency (Spaulding,

2013). As oligopoly is a price maker, SIA restricts their output to maximise

profits, supplying air tickets until marginal cost equals marginal revenue

before it intersects the average total cost curve, SIA will never reach

production efficiency as they never operate at their minimum average total cost

(Spaulding, 2013). As the marginal cost curve never intersects the market

demand curve, SIA supplies less seating than what the market desires, so SIA is

not allocatively efficient (Spaulding, 2013).

Source: Spaulding, (2013)

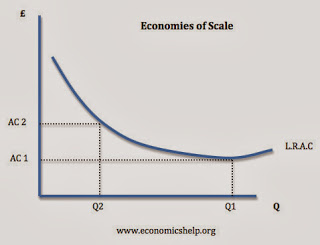

Economies of scale occur when increasing the scale of

production leads to lower cost per unit of output (Sloman, 2012, p.144). SIA

maintained a young and modern aircraft fleet. As of 31 March 2013, SIA have 101

aircrafts with the average age of 6 years and 8 months compared to the

industry-wide average age of 12 years and 3 months (SIA Annual Report

2012/2013). These newer planes were more reliable, quieter, and roomier as well

as a greater flying range, higher fuel efficiency and more seating (Pangarkar

et al, 2010, p.36). These newer planes also make it possible for SIA to cater

to need of business travellers who are time sensitive by providing uninterrupted

long haul flights (Pangarkar et al, 2010, p.36). On February 2013, SIA has also

upgraded Singapore Changi Airport check-in facilities to a new generation

Departure Control System which leverages on a newer technology to improve

customer service (SIA Annual Report 2012/2013). SIA had also ensured it was

self-sufficient in the training needs of its pilots by investing in a flight

stimulator and Learjet 31s to train its cadet pilots (Pangarkar et al, 2010,

p.37). SIA follows a strategy of related diversification (Wikivest, 2010). Some

of the services provided by SIA are passenger and cargo air transportation,

airport terminal services and engineering services (Wikivest, 2010). SIA

Engineering Company (SIAEC) is one of the world’s largest fleet management and

maintenance service providers (SIA Annual Report 2012/2013). This will lower

the maintenance cost of SIA planes as SIA. Singapore Airport Terminal Services (SATS)

provides the ground handling and in-flight catering services in Changi Airport (Wikivest,

2010).

Economies of scope happen when increasing the range of

products produced by the firm reduces the cost of producing each one (Sloman,

2012, p.145). SIA ‘s economies of scope are the subsidiaries companies which it

owned, for example, SilkAir, Scoot and Singapore Airlines Cargo (SIA Annual

Report 2012/2013). SilkAir mainly operates the regional destinations (South East

Asia and India). Scoot is operates the low-cost (budget) long haul flights

while Singapore Airlines Cargo is the designated all cargo airline of SIA. All

these 3 different airlines can share various overhead costs and financial and

organisational economies of SIA (Sloman, 2012, p.145).

In the long run, the Paya Lebar airport was move to Changi

Airport. In 1981, the Singapore government spent S1.5 billion to upgrade Changi

Airport (Pangarkar et al, 2010, p.36). Two finger piers were then added to the

SIA terminal (S$330 million) and the installation of the satellite-based

aircraft tracking system (Long Range Radar and Display System, LORADS II) which

decrease the planes take off time (Pangarkar et al, 2010, p.36). A new terminal

was added in 2008 to increase Changi Airport capacity. Terminal 3 is used to

cater to SIA’s long haul’s flight (Pangarkar et al, 2010, p.36). SIA also have

investment in Changi Airport mainly in its facilities such as hangars,

maintenance centre and catering centre (Pangarkar et al, 2010, p.36).

SIA is an established airline with a good track record for

the last 40 years. SIA has distinguished itself as a pioneer airline in many

different aspects such as inflight entertainment, service quality and comfort.

SIA has also many subsidiaries airline to cater to the different market of

customers (long haul, short haul, and budget). Even though SIA is facing fierce

competitions from many rivals and also the rising operations cost, but if SIA

manage to survive this though period, SIA will once again be one of the largest

long haul airlines.

Securities Investors Association (Singapore) (2006)

Singapore Airlines: Background/ History. Available from: http://sias.org.sg/index9.php?handler=ir&action=ir_info&ir_id=9

[Accessed on 24 October 2013]

Star Alliance (2013) Singapore Airlines: Facts and Figures

Available from: http://www.staralliance.com/en/about/airlines/singapore_airlines/#

[Accessed on 24 October 2013]

Pangarkar, N., Singh, K., Heracleous, L. (2010) Business

Strategy in Asia: A Casebook. 3rd ed. Singapore: Cengage Learning

Asia

Anon (2010) Chapter 3: Airline Economics [lecture to SYSt

461/660 or 750]. George Mason University. Spring 2010. Available from: http://catsr.ite.gmu.edu/SYST660/Chap3_Airline_Economics[2].pdf

[Accessed on 24 October 2013]

Sloman, J., Wride, A., Garrat, D. (2012) Economics. 8th

ed. Italy: Pearson education Limited.

Wells, T. (2012) Airline Industry Group KSB-100-003: Supply

& Demand. Available from: http://airlineindustrygroup.blogspot.com/2012/10/supply-demand.html

[Accessed on 24 October 2013]

Anon (2013) Kaieteur News Online: The Cost of Airline

Tickets is a Function of Demand and Supply. Available from: http://www.kaieteurnewsonline.com/2013/07/10/the-cost-of-airline-tickets-is-a-function-of-demand-and-supply/

[Accessed on 24 October 2013]

Fickling, D. (2012) Bloomberg Businessweek: Singapore

Airlines’s Competition Rises. Available from: http://www.businessweek.com/articles/2012-05-17/singapore-airlines-competition-rises

[Accessed on 24 October 2013]

Tutor2u. Kinked Demand Curve under Oligopoly. Available

from: http://www.tutor2u.net/economics/content/topics/monopoly/kinked_demand.htm

[Accessed 24 October 2013]

Spaulding, W.C. (2013) Oligopoly Pricing Models. Available

from: http://thismatter.com/economics/oligopoly-pricing-models.htm

[Accessed 24 October 2013]

Wikivest (2010) Singapore Airlines (SIN:C6L). Available

from: http://www.wikinvest.com/stock/Singapore_Airlines_(SIN:C6L)

[Accessed 24 October 2013]

SIA Annual Report 2012/2013. Available from: http://www.singaporeair.com/pdf/Investor-Relations/Annual-Report/annualreport1213.pdf

[Accessed 24 October 2013]

Daphne Yoong Li Ting 0317205